For accredited investors, alternative investments (“alts”) can open doors to enhanced diversification and return potential. Alts like private equity, venture capital, private real estate, and hedge funds have historically only been accessible to institutional investors. But regulatory shifts now allow eligible high net worth investors direct access to these opportunities.

What are alternative investments?

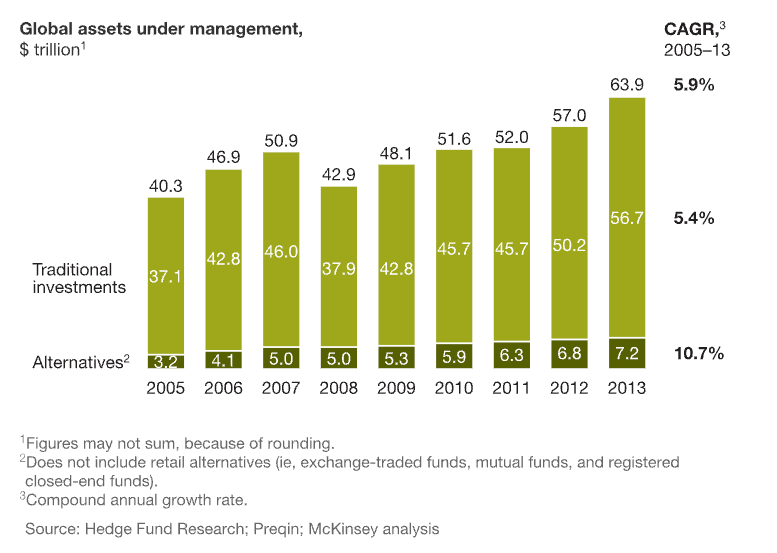

In recent years, alternative investments, or “alts” for short, have become increasingly popular among accredited investors seeking to diversify their portfolios and potentially achieve higher returns. These investments refer to assets that are not traditional stocks, bonds, or cash, such as private equity, private debt, real estate, hedge funds, and crypto. Alternative investments offer benefits like low correlation to traditional asset classes, potential for higher returns, and unique risk characteristics.

However, they also come with drawbacks, including higher fees, less liquidity, and greater complexity. As a result, it is important for investors to carefully consider their goals, risk tolerance, and investment horizon before investing in alternative assets. Additionally, due diligence is critical in this space since many alts are not as widely regulated as traditional assets. Despite these challenges, alternative investments can be a way for accredited investors seeking to diversify their portfolios and reduce overall risk and has grown 10% annually.

Are alternative investments worth the risk?

- High return potential: Alts can provide some of the highest rates of absolute returns across all asset classes. Successful VC investments are numerous: Uber, Zoom, Meta, Google. The best performing asset class of the decade was crypto (an alt!). Bitcoin hit more than $60,000 in 2021 and returned an annualized 230% since launch. This is ten times higher than the Nasdaq 100.

- Risk management: An increasing number of investors are now using alternatives (particularly hedge funds) as a way to dampen portfolio volatility and generate a steady stream of returns. Demand for alternative credit products is growing, driven by challenges posted in the current high interest rate environment.

- Diversification: Many investors also seek to complement low-cost beta achieved through index strategies with the “diversified alpha” and “exotic beta” of alternatives. Further, some of the most sophisticated institutions are letting go of traditional asset-class definition and embrace risk factor-based methodologies, a trend that repositions alternatives from a niche allocation to a central part of the portfolio.

Who can invest in alts?

Historically, investors in alts have consisted of institutional investors, such as pension funds, university endowments, sovereign wealth funds, and foundations. In contrast, individuals invest much less frequently in alts due to lack of access and regulatory considerations, as well as their smaller appetite for risk and limited liquidity.

In the US, only SEC-determined “accredited investors” can invest in alts. An individual can become an accredited investor by satisfying any one of three factors:

- Consistent income of over $200,000 annually (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, OR

- Net worth exceeding $1 million either alone or together with a spouse or spousal equivalent (excluding the value of the person’s primary residence), OR

- Holds in good standing a Series 7, 65 or 82 license

Some alts require investors to hold a greater designation, that of a “qualified purchaser,” meaning they own $5 million or more in investments (as opposed to net worth).

What are the main types of alternative investments?

Several different asset classes are classified as alternative investments, including:

Private Equity

Private Equity (“PE”) encompasses investment strategies centered on acquiring equity stakes in companies across various stages of maturity. These investments are facilitated through fund structures that pool capital from accredited investors. Instead of relying on public markets for liquidity, private equity looks to realization events like sales and IPOs to generate returns. Investors can gain PE exposure either through fund commitments or direct angel investments into startups.

The risk and return profile of PE varies based on the lifecycle stage targeted. Venture capital focuses on nascent companies still finding product-market fit, offering the highest upside but also the greatest risk. Growth equity firms invest in younger companies already exhibiting strong traction and revenue growth. Finally, buyout funds acquire majority stakes in established mature companies with stable cash flows. Though strategies differ, private equity broadly provides investors access to non-public companies and an expanded opportunity set beyond just public stocks and bonds.

Private Debt

Private debt encompasses non-bank-financed and non-publicly traded debt. When companies face difficulty obtaining bank credit, they seek assistance from private debt firms. These firms meticulously assess the company’s viability before tailoring a debt proposal. Since the 2008 crisis, private debt has surged as a leading alternative investment, offering stable returns exceeding public fixed income options. It presents lower risk than private equity, ensuring diversification and access to unique market sectors. Private debt comprises categories like Direct Lending, Mezzanine, and Distressed, each offering distinct risk-return profiles and paths of origination.

Hedge Funds

Hedge funds are pooled investment vehicles that actively manage capital across a diverse array of markets and asset classes. Unlike mutual funds, hedge funds can utilize more complex trading techniques like leverage, derivatives, and short selling. This provides managers the flexibility to pursue absolute returns regardless of broader market conditions. Hedge funds typically have less regulation around their investment mandates, allowing them to implement dynamic strategies across equities, fixed income, currencies, commodities and more.

Real Estate

Real estate is the world’s largest asset class. It stands as the primary source of wealth for many. In 2020, global real estate assets totaled $326.5 trillion, dwarfing equity markets at $93 trillion. Proven historically as a lucrative investment, it mitigates portfolio risk, hedges against inflation/deflation, and provides robust income. Real estate investment vehicles span risk, returns, timeframes, and property types. Categorized by usage (residential, commercial) or risk/return, it’s divided into Core (low risk, income-focused), Core-plus (some risk, light renovation), Value-add (heavier renovation, delayed cash flow), and Opportunistic (intensive renovation, extended cash flow timeline).

Cryptocurrency

Cryptocurrency (“crypto”) is one of the newest alternative assets, and it represents a digital form of value secured by cryptography. Built on blockchain technology, it operates independently of traditional financial systems. Cryptocurrencies like Bitcoin and Ethereum offer opportunities for investment, characterized by their potential for high returns and distinct market dynamics.

How do you get started with alternative investments?

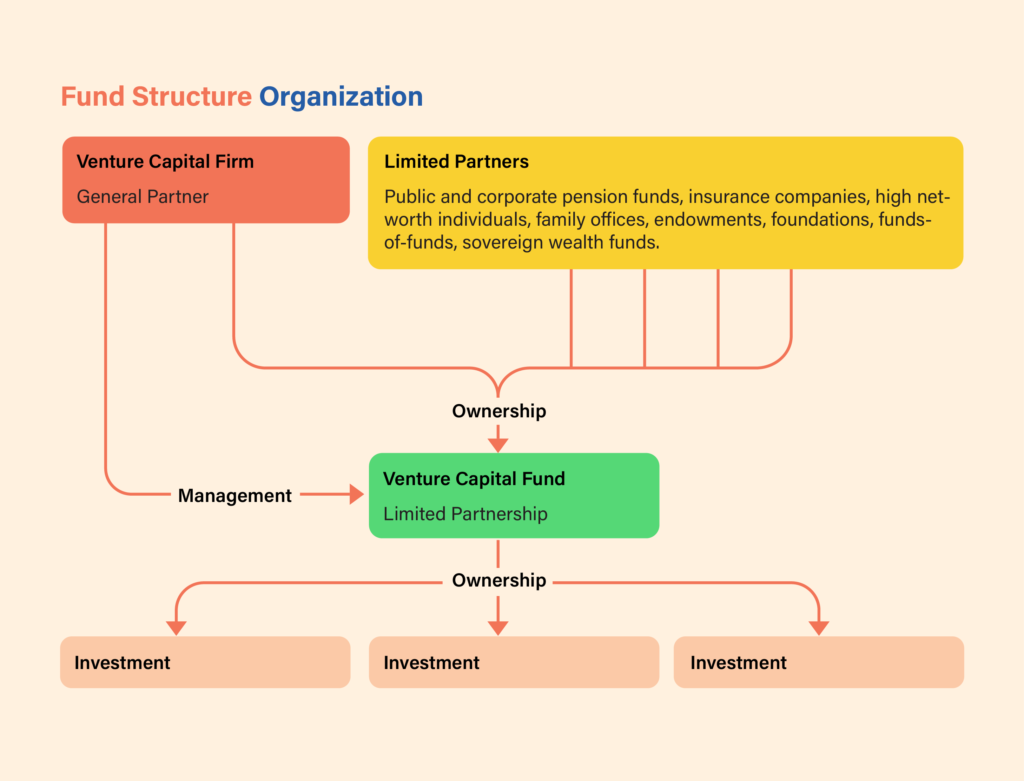

Alternative investments like private equity, private debt, and real estate generally utilize fund structures to aggregate capital from investors. In these arrangements, investment firms establish distinct legal entities known as funds, taking on the role of General Partner. The firm’s partners manage the capital provided by the various Limited Partners who contribute to the fund.

A standard fund operates on a 7-11 year timeline divided into three distinct phases. The first stage involves gathering commitments from Limited Partners to amass the total corpus of investable capital. This “fundraising” period is followed by a 3-5 year span focused on sourcing and executing investment deals, referred to as the “deployment” phase. The final years are dedicated to actively managing the fund’s portfolio holdings and realizing returns through harvest events like sales or IPOs. This culminates in the “harvest” period where successful exits generate profits for distribution back to the Limited Partners.

Given their legal investment eligibility, numerous individuals may be excluded from these investment opportunities due to higher investment minimums and accessibility. Participation in alternative investments hinges on reputation, network and information exchange. For example, some top-tier venture funds exclusively collaborate with reputable institutions or LPs via introductions. Consequently, individuals lacking funds and connections might opt for less established managers, potentially jeopardizing their returns.

In the last decade, technology has has opened up alternative investing to a broader pool of participants. Online platforms like Percent have reduced substantial capital requirements traditionally needed to access these investments. Technology has also improved price transparency and eased operations for raise and managing funds. Through automation and digitization, the historically opaque world is transitioning to be more accessible, efficient, and user-friendly. While still early, innovation promises to further democratize alternative investing and empower more individuals to diversify into these lucrative but once hard-to-access asset classes.